EBITDA

In the complex business world, making well-informed decisions relies on understanding important financial measurements. One such measurement is EBITDA, which stands for Earnings Before Interest, Tax, Depreciation, and Amortization. This metric holds importance for all businesses. EBITDA removes factors that reveal a company’s core operational profitability and disregards distractions like interest, tax, and non-cash charges to provide a view of earnings derived from business operations.

For business owners exploring the journey of entrepreneurship, EBITDA serves as a compass that points out genuine operational strengths and potential weaknesses. In this article, we will explore the concept and all relevant information surrounding business popular terms you might hear commonly nowadays, the EBITDA.

What is EBITDA?

When it comes to measurements, EBITDA stands out as an indicator. This abbreviation, which stands for Earnings Before Interest, Tax, Depreciation, and Amortization, goes beyond being a term—it provides insights into a business’s operational profitability. Now let’s understand the concept of EBITDA:

Earnings:

At the heart of EBITDA lies “Earnings,” which refers to a business income. This is the profit—the figure that every business aims to maximize. It represents the earnings once all operational expenses have been taken into account and deducted. It serves as the gauge of how much money a business truly makes.

Before Interest:

Including “BI” in EBITDA is crucial. By excluding interest expenses—such as charges related to loans, credits, or debts—the metric ensures that it remains unaffected by decisions or debt structures. This allows EBITDA to genuinely reflect strength independently from how the business is funded.

Tax:

Taxes can be complex and vary based on regions, industries, and business setups. The “T”, in EBITDA ensures that we don’t get lost in this complexity. By disregarding tax expenses, EBITDA provides a tax perspective on a company’s profitability. This consistency is particularly important when comparing businesses operating under tax jurisdictions.

Amortization:

Lastly, the ‘DA’ in EBITDA deals with cash charges. Depreciation accounts for the wear and tear of assets, such as machinery or buildings. On the other hand, Amortization delves into assets like patents, trademarks, or goodwill. By excluding these charges, EBITDA ensures that noncash expenses that are often subjective don’t obscure the assessment of earnings.

Therefore, EBITDA acts as a guiding light that reveals the performance of a business. Free from factors and financial complexities, what remains is an unadulterated understanding of a company’s core profitability. This makes EBITDA an invaluable tool, for stakeholders, including investors and business leaders alike.

Why is EBITDA Important, for Businesses?

It is important because of the following:

Operational Profitability:

Operational profitability is crucial for businesses as they often operate on thin profit margins. It provides a measure of profitability derived from core business operations. It helps owners understand the health and viability of their operations without the influence of factors like financing, capital expenditures, and tax environments.

Attracting Investment:

It also plays a role in attracting investment for businesses. Investors look for ventures that demonstrate strength and a healthy EBITDA can signal earnings potential. This makes the business more attractive as an investment opportunity.

Loan Procurement:

Furthermore, banks and lenders consider EBITDA when evaluating business loan applications. A robust EBITDA indicates revenue generation addressing concerns about loan repayments. Having an EBITDA can facilitate access, to essential financing.

Strategic Planning and Forecasting:

Lastly, in dynamic business environments where strategies need adjustments EBITDA serves as an indicator. It helps small businesses gauge the impact of shifts and make decisions accordingly. By analyzing the trends of EBITDA over time businesses can make predictions, about their profitability. This information helps them make decisions about whether to expand, diversify, or downsize.

Competition:

Understanding where a small business stands compared to its competitors is crucial in a landscape. It serves as a metric that allows for comparisons regardless of varying tax structures or depreciation methods used by different businesses. It helps identify areas of strength and potential improvement.

Mergers and Acquisition:

When considering mergers or acquisitions EBITDA plays a role. It is often used in valuations to determine the value of a business’s operations.

Flexibility Across Industries:

One of the advantages of using EBITDA for businesses is its versatility across industries. Whether it’s a tech startup, a local bakery, or a boutique design firm EBITDA provides insights that are universally relevant and understandable.

It goes beyond being another metric, for small businesses; it becomes an essential foundation. It brings clarity to the landscape and guides decisions that can significantly impact the success or failure of a venture. Understanding, monitoring, and optimizing EBITDA should be prioritized by every business aiming for long-term success.

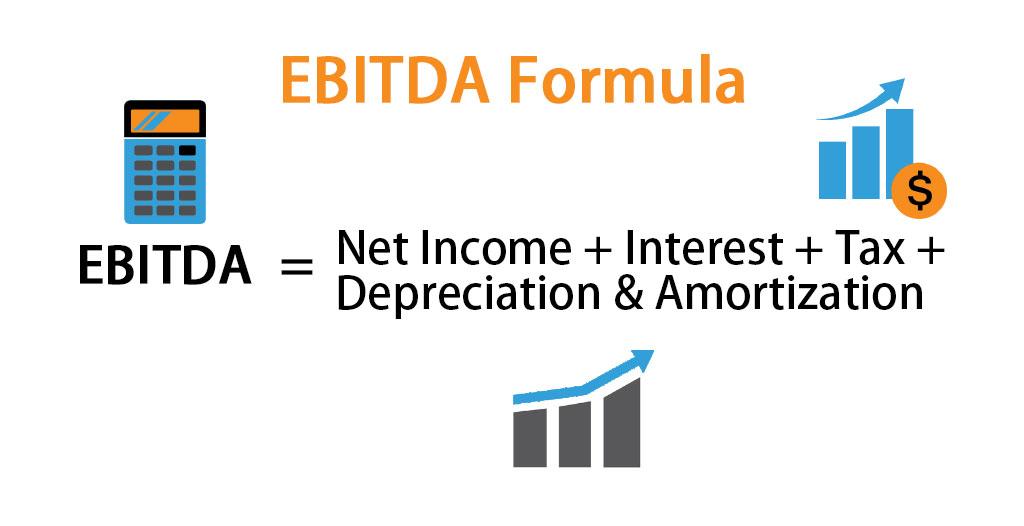

How You Can Calculate EBITDA?

Calculation of EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

You can find these numbers on your income statement. Remember, although the formula is simple, it holds implications and insights.

While EBITDA gives insights into a company’s operations, it’s not the metric to rely on. Here are a few others to consider;

- Net Profit: This represents the profit after deducting all expenses. It provides a view of a company’s financial health.

- Cash Flow: This metric reveals the amount of cash flowing in and out of a business, which is crucial for understanding liquidity.

- EBIT: Short for Earnings Before Interest and Taxes. This measure examines profitability while focusing on financial and tax factors.

Putting EBITDA in the context of your business landscape is essential. For example, if you’re considering a capital investment or expansion a strong EBITDA indicates that your core operations are solid. However, you should also assess metrics, like cash flow, to ensure that the investment won’t strain your resources.

Benefits of EBITDA

1. Simplified Assessment:

EBITDA, which stands for Earnings Before Interest, Tax, Depreciation, and Amortization is widely recognized for its ability to simplify analysis. By focusing on earnings generated from business operations It provides an easily comprehensible metric. For companies, including medium enterprises (SMEs), with straightforward capital structures, EBITDA serves as a simple measure of operational health. This exclusive emphasis on earnings allows stakeholders at all levels of knowledge to quickly understand a company’s performance. Its simplicity makes it accessible and easy to communicate throughout the hierarchy.

2. Financial Adaptability:

Another advantage of EBITDA is its flexibility. Businesses operating in regions with distinct tax environments and diverse tangible assets can benefit from using it as a common denominator. By excluding interest, tax, and depreciation factors EBITDA offers a measurement that remains unaffected by tax variations or the different lifecycles of tangible assets. For corporations or SMEs with a presence employing EBITDA facilitates comparability and uniformity, in financial evaluations that would otherwise be challenging to achieve.

Critiques of EBITDA

1. Not Directly Connected to Cash Flow:

Despite its strengths, EBITDA has faced scrutiny for not being linked to cash flow. While it offers a snapshot of profitability, it doesn’t always align with the liquidity a company possesses. For example, a company may have an EBITDA that indicates earnings from operations but still struggles with cash flow issues due to significant capital expenses or delayed payments. This disparity can sometimes create an outlook, potentially misleading investors and stakeholders into believing that the company is in a robust financial position when it’s dealing with cash limitations.

2. Potential for Misrepresentation:

Another limitation associated with EBITDA is the possibility of misrepresentation. Because it excludes factors like interest, taxes, depreciation, and amortization, businesses might sometimes use it to present a financial picture than reality suggests. For instance, an indebted company could still showcase an EBITDA while conveniently downplaying concerns related to debt repayments or interest obligations. Similarly, companies, with assets might face significant depreciation costs that inflate perceived profitability when omitted.

3. Overlooking Working Capital Needs:

Sometimes when companies selectively represent their health, they can be overly optimistic. One area where this optimism can be misleading is the focus on EBITDA, which only considers earnings from operations and overlooks the complexities of working capital management. Working capital management is crucial for businesses as it reflects their ability to handle short-term obligations. Even if a company has an EBITDA, it may still face challenges if it doesn’t effectively manage inventory accounts receivable or accounts payable. This can lead to liquidity problems that impact business operations. Therefore EBITDA alone might not provide a picture of a company’s financial well-being.

4. Lack of Universal Acceptance:

It’s also important to note that not all industries or financial analysts universally accept or favor EBITDA as a metric. Different sectors may have industry measures that offer detailed and relevant assessments of financial health. For example, industries with capital expenditures might prioritize cash flow as a more appropriate metric. Stakeholders must exercise caution and consider the context and nuances of each industry when relying on EBITDA, for evaluating performance.

Closing note:

EBITDA, while a tool, is one of the many financial resources available to small business owners. Its value lies in its ability to provide an understanding of profitability, serving as a guide for decision-making, attracting investors, and setting benchmarks.

However, like any tool, it’s important to consider the context. While a high EBITDA is favorable, it’s crucial to understand how it relates to metrics the financial landscape, and your specific business objectives.

For businesses navigating the turbulent waters of business finance, EBITDA can act as a reliable compass. Nevertheless, always remember to plot your course using a combination of metrics insights from experts in the field and professional guidance.

If you require an analysis tailored specifically to your business or if you need comprehensive accounting and bookkeeping services, please don’t hesitate to get in touch with us.